Introduction of Home Insurance?

home insurance help to cover the homeowner as well as the property inside a home in case of an accident. If disaster or an accident occurred involving your home you are not helpless, through the Home Insurance. It provides for loss through fire and floods. It simply means the feeling of safety because of the insurance of such situations as the lost opportunities and other related events which the given individual cannot control.

Home Insurance Coverages:

- Fire: This is about harm from the flame, awfully hit by the smoke and the backlash of heat.

- Lightning: This summed up loss, associated with natural disasters especially the effects of lightning.

- Windstorms and Hail: This includes destructive losses in storm, twisters, and hail

- Explosions: This falls under explosion for instance because of leakage of gases in this regard.

- Demonstrations and Civil Disorders: This especially includes violence which is conducted by demonstrations, which consist of such acts as painting, destroying other people’s property and anything that is of unlawful resistance to authority

- Vehicles: To begin with, these comprise of effects that arise from car banging into your house.

- Aircraft: This implies loss that could be as a result of a plane falling on your structure since it equally implies the structure may have to be rebuilt.

- Smoke damage: This encompasses harm which accrues from smoke even if there were no fires.

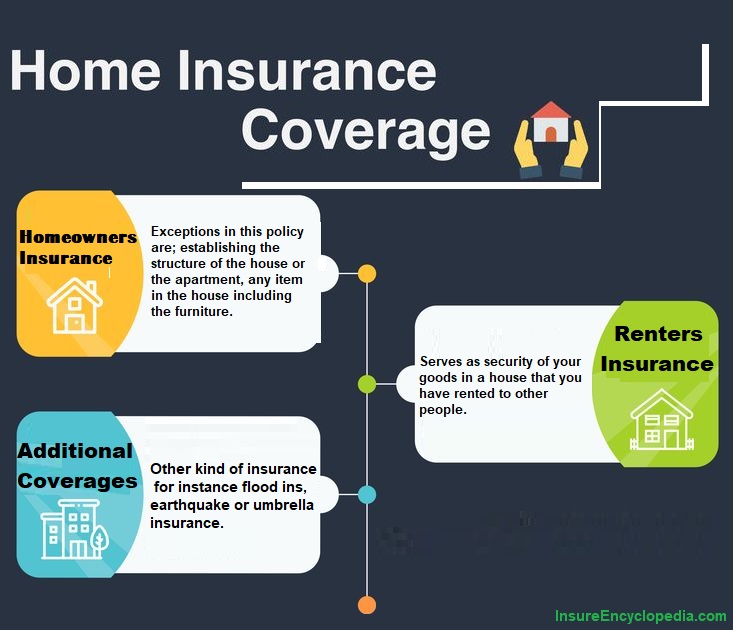

Understand Coverage Options:

- Homeowners Insurance: Exceptions in this policy are; establishing the structure of the house or the apartment, any item in the house including the furniture.

- Renters Insurance: Serves as security of your goods in a house that you have rented to other people.

- Additional Coverages: Other kind of insurance for instance flood ins, earthquake or umbrella insurance.

What’s Home Insurance Doesn’t Cover:

- Natural disasters: Personal residences are usually protected through Home Insurance floods and earthquake which to a certain range of are unrelated.

- Wear and tear: This does not include any reduction, meaning any toll that is taken on your home by the managers or any wear out or decline with time.

- Pests and invasions: Ordinarily it is excluded to recover for losses through dangers that may be occurred by termites, pest or rods.

- Mold and mildew: Wear and tear, regular breakdown, mold, and mildew are not claims that would be paid for without they are as a result of an existence that is recoverable.

- Intentional damage: An example is a situation where the loss was as a result of action by the policyholder, any resident in the mentioned policyholder’s household

- Business-related losses: For example, if one has business that conduct within the complex of home may require the extra insurance.

How to choose right Home Insurance Policy?

Assess Your Needs

- Property Value: Instead seek the value of the new structures in the compounds for the act of replacing the old ones.

- Location: Here, some important questions may be raised for example the level of shocks or natural disasters that may be expected here such as earthquakes.

- Coverage Preferences: Decide if you wish to be taken through the compulsory insurance policy exclusively or if you would wish to be introduced to the other insurance policy such as flood and earthquake insurance policy.

Compare Policies

- Coverage Limits: It is also notable that in this policy your property together with your items should also be well protected.

- Premiums: No, I would kindly request you to go look for estimates from another insurance company.

- Discounts: One can negotiate for the discount like when taking another insurance or if the home has is equipped with a security system.

Review Policy Carefully

- Understand Rejections: What it does not cover for examples it does not cover circumstances such as, floods, earthquakes or decline.

- Read Fine Print: As for what has been said above in reference to the policies, one has to be relatively definite with regard to the terms and conditions.

- Ask Questions: They expected that it is allowed to ask them if there is some amount of risk involved.

Update Regularly

- Update Property Values: This suggests that in order to bring down the limits on cover, one can contribute a smaller amount of money since the costs of property escalate as has been noted.

- Inform Insurer of Changes: Let your insurer know some things which occur i.e. home renovation, expansion of the land.

How can we Prevent ourselves from Home Insurance Fraud Detection?

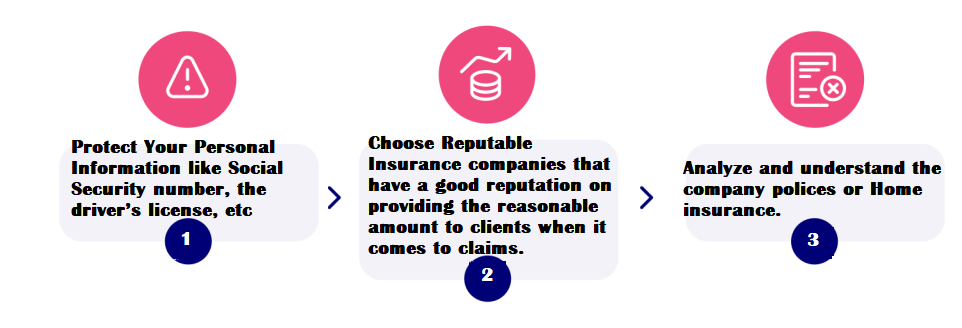

- Analysis Your Policy: Analyze and understand the company polices before insurance and fulfill all the requirements before applying Home Insurance. The company will verify all the documents upon which they will decide either you are eligible or not for Insurance. Insurance Companies covers all the things which are not covered will have to be provided for by the organization.

- Report Suspicious Activity: In other reasons you have the impression that your insurance company is involved in any of the items registered in this section, report all cases of frauds to the insurance company as the first instance.

- Protect Your Personal Information: As for privacy, there is a need to protect such information as the Social Security number, the driver’s license, etc.

- Choose Reputable Companies: Choose only those insuring companies that have a good reputation on providing the reasonable amount to clients when it comes to claims.

How can Home Insurance Companies detect fraud?

- Implement Fraud Detection Systems: Go to a help of new technology and identify cases of the fraud.

- Create Awareness Campaigns: This goal is to a create awareness to the public that a lot of harm is going to be caused by insurance fraud.

- Enforce Strict Penalties: This is so since insurance fraud should be deterrent crime so that severe punishment has to be given out on it.

- Collaborate with Law Enforcement Institutes: It is the crime to attempt to cheat insurance, and people should stand behind the authorities fighting with the fraudsters.

Summary:

It protects your house and everything in it against any form of damage that can be fire, storm or even theft. It also shields you in a situation where the third party that introduced a destruction into your portion of property was cleared.