What is Crisis Management Insurance?

Crisis Management Insurance is a type of insurance it aims at offering organizations protection from the effects of the crisis. It contributes towards obtaining funds that are required in managing some of the risks that may have negative influence on the organization’s brand image, operations and market opportunities for sales.

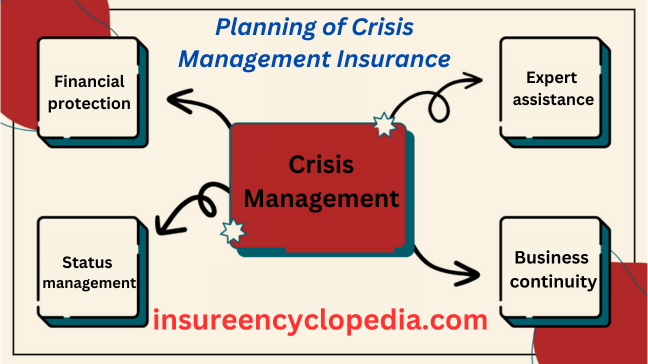

Planning of Crisis Management Insurance:

- Financial protection: Such comprises of the costs that maybe used to deal with a specific crisis such as public relations cost, legal cost and any other cost that the business may be faced with because of the particular crisis.

- Expert assistance: Gives the possibility to attract professionals of crisis management officers who will help in this issue to the company.

- Status management: Helps to communicate with and reassure the organization’s stakeholders of the image and brand in the course of and after the disaster.

- Business continuity: Is in favor of efforts at getting back to the new normal as soon as possible.

How Crisis Management Insurance Works?

Crisis management insurance remains as an insurance product designed to provide a backstop in the occurrence of negative events.

- Policy Activation: Once there is an incident that has occurred, the insured company informs the insurance provider of the disaster to start the claims process.

- Crisis Assessment: Whether or not the event is covered under the policy, the insurance company has to carry out its evaluation so that it can come up with the payout.

- Coverage Activation: After the claim has been well approved, insurance policy offers funding for several necessary expenses of the crisis management.

- Expert Assistance: Most policies make provision for access to specialist in crisis management whom can assist the company in the process.

- Financial Reimbursement: The insurance company then compensates the insured for his/or her expenses including public relation cost, legal expenses, business interruption losses and all other expenses as may be incurred.

- Crisis Mitigation: Through insurance, this relieves the company from having to pay for the extra costs that are associated with a management of a crisis.

Crisis Management Insurance for Healthcare:

Crisis management insurance for the health care also known as force major insurance. Besides this, like any other industry, the health care industry does not lack predisposing factors to crises including security challenges, product recalls, acts of nature; several diseases among them. Management of the incidences demand crisis management insurance to provide for the monetary and image loses for the healthcare providers.

Key Coverage Areas for Healthcare:

- Product Recall: This costs emanate from recalling of defective medical equipment and medication that have gone bad.

- Data Breach: If Data breaches occur, reimburses costs associated with losses like attorney’s fee, cost of notification and Credit Monitoring to the affected Patients.

- Workplace Violence: Outlaws liability for losses in circumstances of violent actions that transpire in a healthcare facility.

- Public Health Crises: Governments pay for things touching on COVID-19 or any other calamity that affects people’s lives.

- Natural Disasters: Provides for cost that results from natural incidences for instance fires, floods, cyclones for properties, operations, and evacuation.

Additional Benefits for Healthcare Providers:

- Crisis Management Expertise: Essentially, all the insurers offer a line that a healthcare provider could use to get in touch with professionals that could assist in handling a challenging crisis.

- Reputation Management: Helps in supporting the image of the healthcare provider or the brand during the occurrence of the event and after.

- Business Continuity: Support efforts aimed at attempting to restore operations to as optimal a level as soon as possible and to not create a lot of hardship on the patients.

One could then argue that crisis management insurance is essential in the health care industry in as much as it seeks to safeguard the patients, the employees and the health care organizations. As regards the particular risks the healthcare institutions are exposed to, the insurers are in a position to develop the policies meeting the needs of the organizations.

Crisis Management Insurance and Public Relations:

Among the insurance that are useful during crisis management are; Crisis Management Insurance and Public Relation Insurance.

Key roles of PR in crisis management:

- Reputation Protection: Also, there is need to agree that PR can contribute towards reducing suffering loss of reputation for a company during a crisis.

- Stakeholder Communication: There key tasks concern the management of stakeholders such as media, customers, employees and shareholders.

- Crisis Communication: In fact, one way of regaining control is the management of the crisis communication plan.

- Crisis Response Teams: The public relation departments also stay in touch with the crisis management teams with a view to perfecting the contact as well as the steps required.

- Risk: A study on insurance and public relation during crisis

- Financial Support: Insurance provides PR finances for such products like media monitoring, PR counsels and press releases and materials in connection with the crisis situation.

- Expert Access: Almost all of them provide an opportunity to turn to PR specialists in the client company in a crisis.

- Crisis Communication Support: The following are the ways that insurance can be of assistance in the funding of the preparation and the commencement of the crisis communication plan.

- Media Training: Some of the policies may include the reimbursement of media training of the selected personnel from the company.

Keeping PR as an integrated part of crisis management insurance let’s reduce the effect of the crisis on the business.

The Crisis Management Insurance Claims Process:

On the subject, we shall be looking at how crisis is managed in relation to insurance claims. Claiming for crisis management insurance is done differently and effectively to help recover the damages.

- Immediate Notification: In the event of crisis, endeavor to give notice to your insurer. It sets off the claims process and allows the insurer to start making the assessments.

- Documentation: Make sure you gather all the papers including; Financial, media/press, legal & other printed documents & internal reports up to the time of the crisis. The following documents will support your statement.

- Claim Submission: Forward the claim to the insurance company, with procedures if any that the insurance company will deem necessary and fill all the details as and when required.

- Investigation: The insurance company will also verify on whether the event is in the insurance policy and on the extent of the loss that needs to be made good.

- Loss Assessment: The insurer will determine how much was lost as a result of the crisis in terms of admissible expenses which may include those incurred on public relations, legal and other business loses due to interruption.

- Claim Adjustment: From the above findings and losses highlighted above, the insurer will be in the position to determine the amount which would be paid under the policy.

- Payment and Recovery: In the event that the insurer has agreed to the claim, he will pay the insured amount that will cater for the expenses that have been established. I also remember that the insulated can then focus on emerging from the crisis.

What one should grasp is that the process of claims may vary either with respect to insurance policy and/or with respect to the type of crisis. Paper work should be done right from the moment the crisis evolves so as to build enough evidence for a claim.