What is Broadcasters Liability Insurance?

Broadcasters Liability Insurance is a sort of professional insurance that is intended to help defend radio and television stations, as well as other organizations in the mass media, from significant fiscal losses because of legal actions that are initiated because of the content aired. This coverage provides coverage for: legal liability arising out of negligence or mere error or omission in the conduct of its business; defamation and/or libel; slander and/or malicious persecution; infringement of authors, composers and/or owners of copyrights; and any and all legal actions that may be instituted against the Company occasioned by the Company’s operation of the broadcasting business.

How Does Broadcasters Liability Insurance Work?

- Risk Assessment: Possible hazards depend upon or are related to the kind of programs the broadcaster airs, the audience it targets, and possible legal concerns thus insurers conduct a so-called specific risk assessment of the broadcaster relative to them.

- Policy Customization: Standing on these results, insurers build an insurance policy that will actually suit the needs of the broadcaster, and they set limits and sometimes exclusions for the insurance that they are offering.

- Claim Filing: During the legal action or the claim of the money by the channel, the broadcaster informs the insurance company for the claim.

- Legal Defense: Legal defense is offered by the insurer, specifically all the expenses linked with it.

- Settlement or Judgment: If there is a settlement or judgment, the insurer gives out cash settlement to the policyholder up to the amount of policy limit.

Thus, returning the financial risk to the insurer, broadcasters can concentrate on their activity and do not consider the threat of expensive trials.

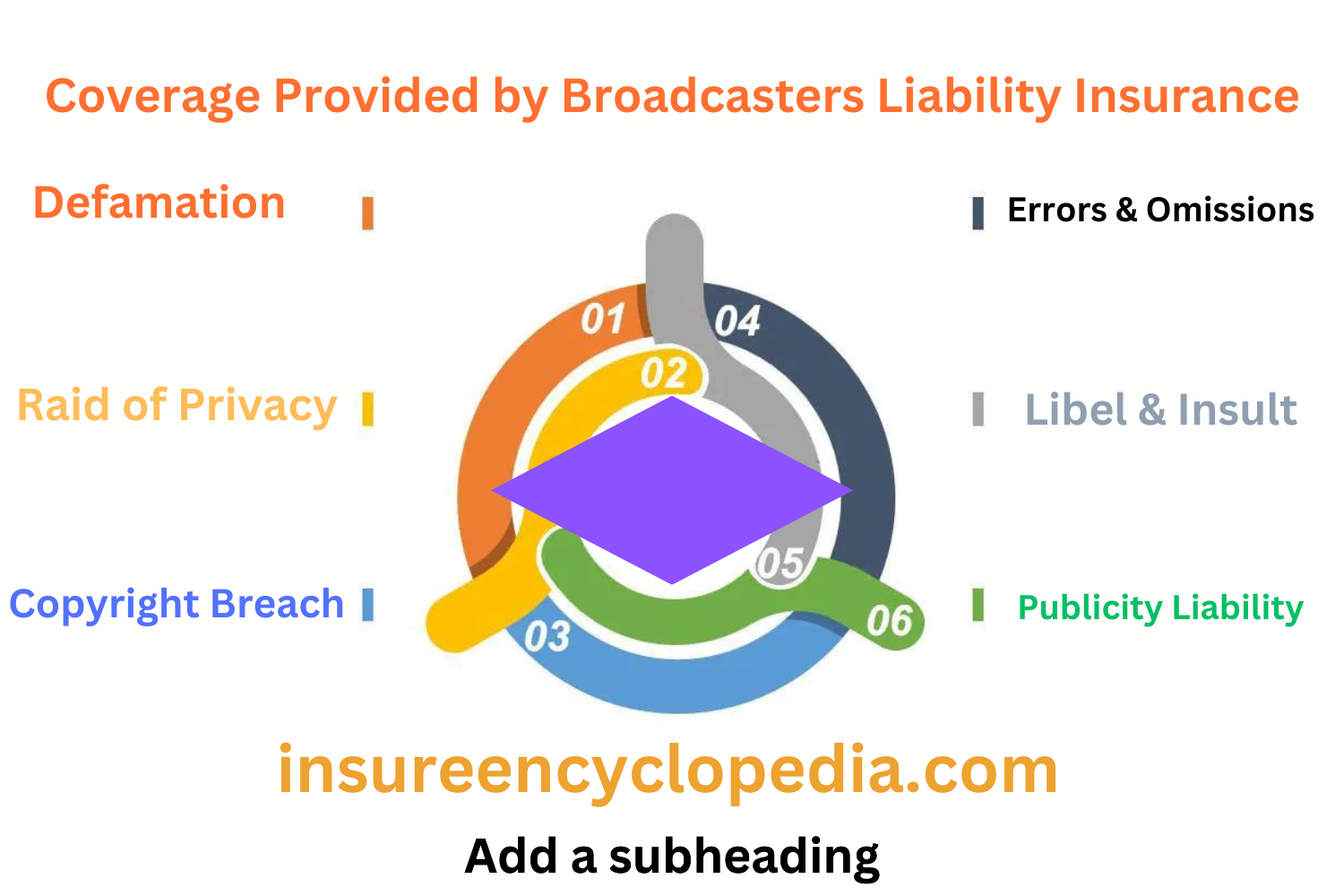

Coverage Provided by Broadcasters Liability Insurance:

- Defamation: Assists in managing the suits that may include defamation and this especially where the accused person made statements that would be most embarrassing upon the intended person or business.

- Raid of Privacy: Adopts cases related to the legal proceedings where right to privacy has been raised should where personal data concerning an organization or a person have been processed without his/her consent.

- Copyright Breach: Provides indemnity for any claim that may arise this is due to the violation of the principles of copyright for instance the using of a material that is copyrighted.

- Errors & Omissions: Restricts errors or setbacks on posting materials on some places.

- Libel & Insult: Manages legal liabilities for reimbursement with regard to defamation and slander or libel.

- Publicity Liability: This cover standard coverage to do with falsely deceptive advertising.

Exclusions in Broadcasters Liability Insurance Policies:

- Criminal Acts: This is in addition to criminal acts which are not insurable: the policy does not cover claims resulting from criminal activity.

- Contractual Obligations: Those external costs defined as incidental to the contract breaches are the usual sort left out the costs that are associated with contract performance.

- Known Risks: The insurer may limit the risks that will not be reinsured where they contain a term that means all the circumstances that the insured considered to be material when entering into the policy will not be fulfilled.

- War and Terrorism: Any cost related to either war or act of terrorism is deliberately excluded in this regard.

Broadcasters Liability Insurance Claims Process:

- Notification: Where a claim may be made, or a suit is most likely to be brought in future, the broadcaster is under the duty to report the insurer.

- Investigation: He or she also guarantees that the insurer examines the case and makes a decision as to whether the client is to be compensated and, if so, how much.

- Legal Representation: A provision made is that in as much as the insured is lawfully engaged in the business of broadcasting the insurer should defend and Pay for the broadcaster any time they are sued.

- Settlement or Judgment: In the event of a settlement of the case or entry of a judgment, then the firm of insurance pays the amount of expenses in drive with the policy.

- Documentation: Another impact is that for the case to be tenable the claimant should have documents of the injury and the relating activity.

It is, therefore, desirable that every one of us develops adequate knowledge of these components to build on the positives of broadcaster’s liability insurance without adding painful lessons to the vices that may be attached to it.

Factors Affecting Broadcasters Liability Insurance Premiums:

- Type of Broadcast: Television, radio, or online broadcasting is not the same, they have different risks with them.

- Content Type: Cases in point are newscasts, entertainments, or the talk show programs, which are normally considered to intrinsically contain different levels of risk.

- Audience Size: In common practice, the extent of exposure determines the premium to be paid; the higher the exposure the higher the premium since the holders of the insurance.

- Claims History: These past clams are in fixing the premium rates very important.

- Regulatory Environment: Premiums therefore are in proportion to the regulation.

- Coverage Limits: As is to be expected, getting coverage at higher limits attracts paying a higher premium amount.

Choosing the Right Broadcasters Liability Insurance Policy:

- Risk Assessment: It will be significant to identify few probable risks that would impact the broadcasting activities here are some of the risks;

- Coverage Analysis: It is compared with other policy insurers to check adequacy of the cover for your needs Researchers rate.

- Policy Limits: Identify where within the size and probably exposure of your business it is possible to fall.

- Deductibles: Think, how much deductible may influence the premiums and how much of the financial risk it is possible to resolve one’s self for.

- Insurance Broker: I would refer to an insurance broker so as to ensure that I was able to get the right policy which is available in the company.

- Policy Review: However, it will be equally useful to also learn how it applies to you in the management of your business while running a business concern.

Thus the broadcasters are in a vantage place to make the proper decisions on their insurance and to steer their business clear of several possible loss scenarios.

Enhancing Business Confidence with Broadcasters Liability Insurance:

Another function of the Broadcasters liability Insurance is that it helps the media industry to regain the lost confidence and investment among business entities. As nerve Centre to broadcasters, it supports them with a financial backstop against legal risks so that they can run their businesses instead of being constantly preoccupied by the threat of financial disaster.

The way Broadcasters Liability Insurance boosts confidence:

- Risk Mitigation: This means that broadcasters can easily manage potential lawsuits that may occur to them in the Course of their work since the financial implication is shifted on the insurer who handles it.

- Business Continuity: In a case of a legal claim the insurance assists in continuation of business because the claims are paid.

- Decision Making: When the target audience of the broadcasters is insured, then they can make much more confident decisions on the programs and the content.

- Investor Confidence: Proving financial responsibility in the way of insurance can spur investment from the investor and partnership from the partner.

- Reputation Protection: As we can see, insurance does not protect from receiving negative publicity but can significantly reduce monetary fines given to reputational damage.