Private Medical Insurance: Your Shield of Protection

Private Medical Insurance is a private legal relation in which an individual of a party or an organization obtains a guaranty with a payment by a medical insurance company, as to the future payment of certain kinds of necessary medical costs. For that reason, the insurer in return undertakes to reimburse a specific percentage.

This financial protection is needed for the fact that diseases, or accidents that are most probably are not covered in cheap plans may lead to expensive medical expenses. International Consideration of private health insurance

now there is the large phenomenon and organization of PMC in various countries.

Medical Insurances in Developed Nations:

Individualistic countries like the USA, Switzerland, and Germany, for example, have a highly developed system of health insurance provision, and sometimes can be considered as functioning in parallel with the public health care services.

These are generally true for most of the developing countries, wherein private insurance is emerging as the apparent solutions for the growing middle-class population that is expecting improved health care solutions.

Emerging Economies:

At present, both Indian and Chinese markets have experienced a quite serious development of the private health insurance due to tendencies like the increase in the costs of health care services and the increasing demand for better and improved access to them.

Why people get Private Medical Insurance?

Why people go for private medical insurance; the causes are many; most commonly they are desire to have control over one’s health, anticipation for fast treatment or protection from what one can get from credit crunched world.

These are the two main explained reasons:

Faster Access to Care

- Shorter waiting times: In this regard, it is essential to note that private care is considerably more efficient, which is why clients can be seen and have operations or diagnoses performed faster than in the facilities of the public healthcare system.

- Choice of providers: This means that the policyholders have options concerning the choice of physicians and hospital of their preference and this in turn may lead to the development of a better care plan.

Choice and Control

- Personalized care: Private health care delivery system means that the patient has a greater control over some of the decisions to be made concerning his or her health.

- Private facilities: It is a fact that majority of individuals find that private hospitals and clinics are comfortable, private and equipped with facilities.

Importance of Health Insurance:

You receive medical health insurance as a monetary security that can assist you from experiencing tremendously expensive medical costs. It reassures one and gets a guarantee that in case a person needs the various treatments, he or she will not be financially crippled.

Here is why the health insurance is important:

- Protection from Unexpected Costs: Sick vary in their nature and may occur at any time and therefore require very huge amount of cash to be provided. These costs are eased by getting health insurance.

- Access to Quality Care: Among the insurance plans are such benefits as doctors’ list, health care facilities, and specialists for proper treatment.

- Financial Stability: This is particularly so if the individual has no health insurance cover; he or she can easily be brought to his or her knees through an unfavorable medical incidence. Insurance is a constraint that helps in guarding your money and possessions.

- Preventive Care: The health services provide an opportunity to care for yourself and receive check-ups, and other screening examinations as it embraces the aspect of a preventive manner.

- Peace of Mind: This assurance frees one from the concern of rising cost of treatments thus one is able focus on own health.

How to Estimate Health Insurance Budget:

Health insurance budgeting entails that the amount, which can be spent on medical expenses are defined by the total cost of factors that makes it up.

Key Components of Health Insurance Budget:

- Premiums: The sum of money of which you are expected to add on to the cost of the insurance plan you select for your car.

- Deductibles: Pertains to the out-of-pocket expenses therefore incurred by the consumer for covered services that health insurance is to supplement.

- Co-pays: Payments made with regard to the acquisition of specific forms of health care services.

- Coinsurance: A sum of money which a policy holder pays together with a lump sum when the cash- Contribution balance with the insurer is reached.

- Out-of-pocket maximum: An equation that will enable you to get the total amount to be spent on all the services that will be catered in a year.

Steps to Estimate Medical Insurance Budget

- Assess Your Health Needs: In terms of decision factors which you have to consider there are age, illnesses, and expected future medical costs.

- Compare Plans: Citing some insurance companies and their aim of the insurance and then comparing the premiums, the deductible, co-pay options and the coverage.

- Factor in Additional Costs: Include the expenses of the drugs or other charges which are in the prescription, over the counter drugs, Dental, Vision if they are not included in the plan of your health.

- Create a Realistic Estimate: Depending on your health history and the likely future healthcare needs, you should try to estimate about how many in on average you will be spending on the sum of deductible, co-payment, or coinsurance.

- Consider Tax Benefits: Identify if in as much as health insurance is concerned, you can be allowed some tax deductions or credits.

Tips for Budgeting Medical Insurance

- Use Online Tools: It will also be important to calculate the cost on insurance sites and normally there are specific calculator to help in calculating the cost depending on the kind of plan that has been selected.

- Review past Medical Expenses: While insurance, catering and most products follow a curve, health care costs have risen intensely; Estimate your future bills through your previous bills.

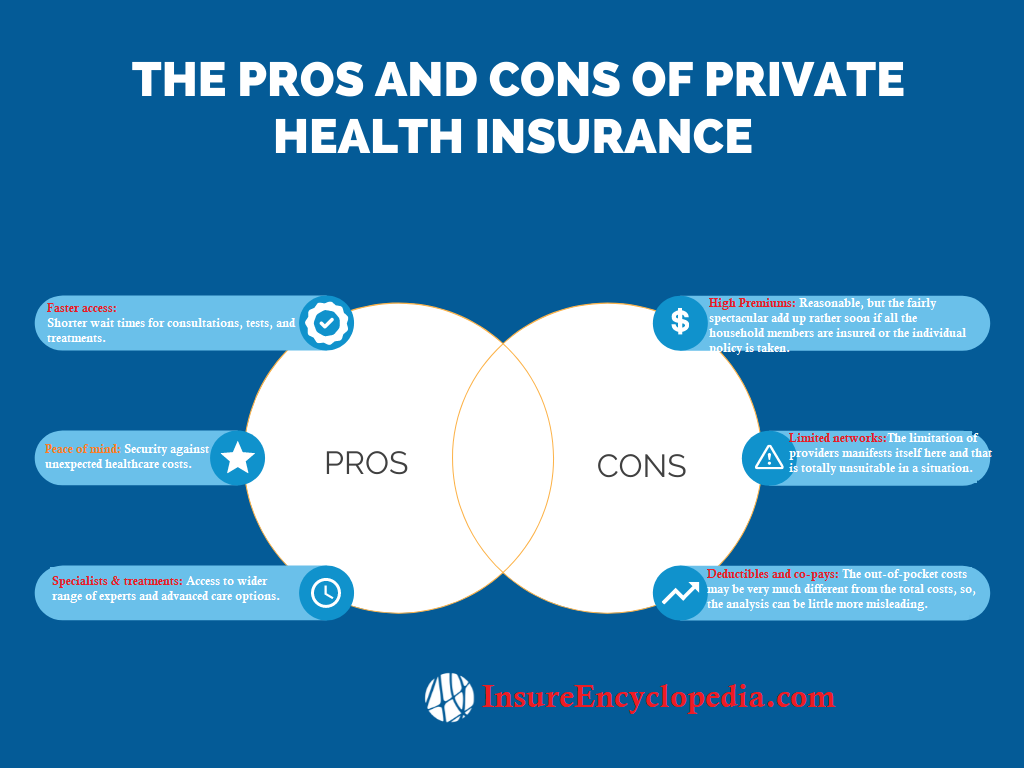

Private medical insurance, while offering benefits, also has its drawbacks: On the same note, it is also pertinent to note that the conception established in this paper about private medical insurance, has its drawback.

Merits of Private Health Insurance

- Faster access: Shorter wait times for discussions, tests, and treatments.

- Choice: Select ideal doctors, specialists, and hospitals.

- Specialists & treatments: Contact to wider range of experts and radical care options.

- Privacy & comfort: Private rooms, personalized care, and easy settings.

- Financial protection: Covers medical costs, reducing out-of-pocket payments.

- Peace of mind: Security against unexpected healthcare costs.

Demerits of Private Health Insurance:

Cost

- High premiums: They are reasonable, but the fairly spectacular add up rather soon if all the household members are insured or the individual policy is taken.

- Deductibles and co-pays: Thus, the out-of-pocket costs may be very much different from the total costs, so, the analysis in this regard can be little more misleading.

Coverage Limitations

- Pre-existing conditions: Some of those might be restricted in the sense that they could operate only in a certain area of specialization or they might not even be in existence at all.

- Limited networks: It will be possible to state that the limitation of providers manifests itself here and that is totally unsuitable in a situation when the question arises of the types of service.

Excluded services:

- Regarding this it is necessary to pinpoint the fact that some of the mentioned treatment, drugs, and process can be paid.

Summary:

Private medical insurance affects an agreement that is made between a particular individual and an insurance company. Consequently, for the provision of the regular premiums, the insurer is required to pay all or several medical costs of the insured individual. These are often the hospitalizations, surgeries, doctors’ visits and the medicine. Physical health ailments are indeed integrated into everyday life quite easily because they are circumstantial.